Empowering specialty underwriters

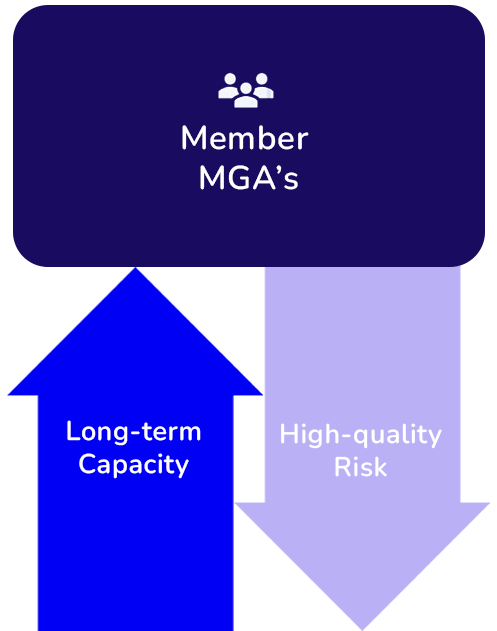

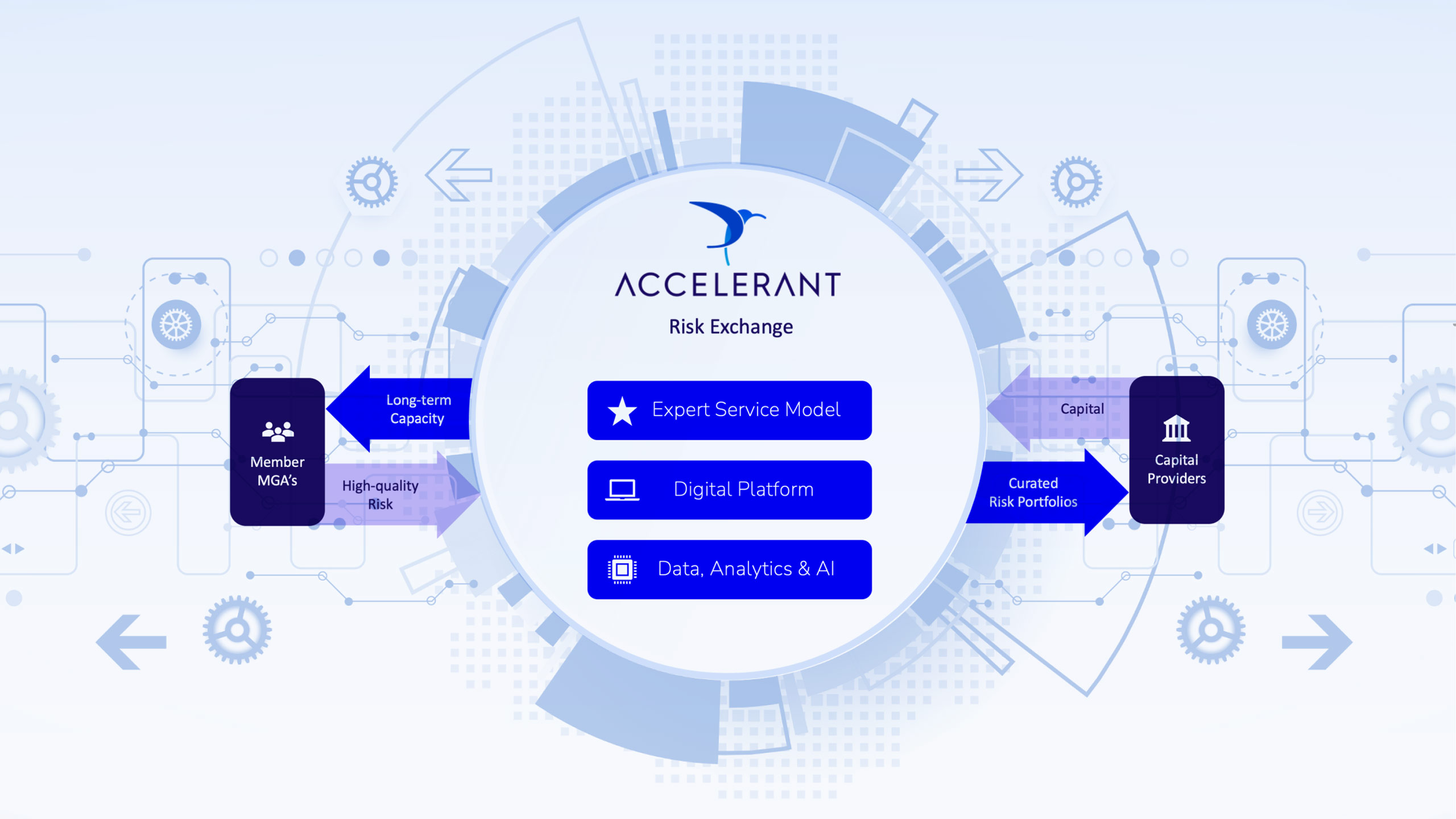

Accelerant is a data-driven risk exchange connecting specialty underwriters with risk capital.

Small businesses power our economy. Our risk exchange keeps them insured

Specialty underwriters are better positioned than anyone to serve the needs of small and mid-sized businesses. They’re closer. Hungrier. Faster.

We built Accelerant to move in lockstep with them — supporting their growth, while addressing needs across the specialty insurance value chain.

Our platform arms our ambitious Members with the right data and insights to drive market-leading, profitable growth. Then the platform connects these outstanding portfolios with Risk Capital Partners.

What sets us apart

Diversified, low-volatility risk portfolio

0

Year Capacity Agreements

A Risk Exchange connecting 155 Members with 65+ Risk Capital Partners

A-

(Excellent) Financial Size IX by AM Best

Turning data into insights

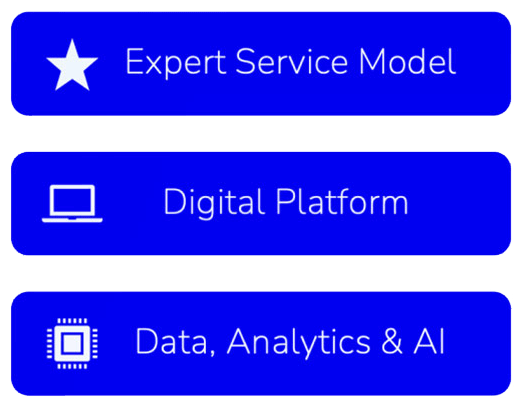

Our Risk Exchange uses purpose-built technology and high-fidelity exposure data

to eliminate information and operational barriers

Who we serve

We believe in a world where insurance is fair, transparent, and efficient. We are creating that future at Accelerant.

The Accelerant Way

We believe in a world where insurance is fair, transparent, and efficient. We are creating that future at Accelerant.

01

Member-obsessed

We are laser focused on unlocking each of our Members’ unique capabilities to fully unleash their potential.

02

Technology-driven

Our digital-first Risk Exchange provides a seamless and transparent experience for Members and Risk Capital Partners – supported by insight-rich data and analytics.

03

Team of experts

We pair each Member with an expert service team providing them with responsive underwriting, actuarial, claims, and strategic support to help them thrive.

What Our Members Say